If you get one unit of joy for each material possession, that’s frugal. But if you need ten possessions to even begin registering on the joy meter. You’re missing the point of being alive.

Your Money or Your Life

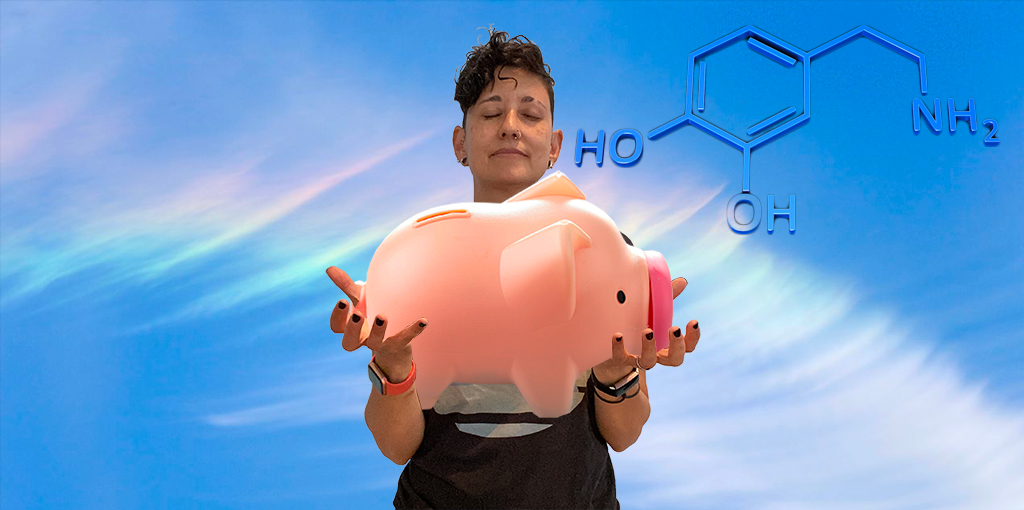

Marketing companies have succeeded in harnessing the power of Dopamine — the “pleasure” hormone — to get us to buy stuff. We see something we didn’t know we needed a minute ago on an Instagram targeted ad and seconds later it’s in our cart. We’ve been trained to get high off of buying things and the result can be credit card debt, a low savings rate and being surrounded by piles of stuff left unopened, unused we barely remember buying.

We need to switch our Dopamine response from spending to saving.

We need to get high off of having enough — appreciate the things we already have and feel good from not buying things that will inevitably wind up in a landfill. If we can do that we’ll be more at peace by not being in a constant state of materialistic want. I believe we can train ourselves to do this like companies have us trained to spend.

Let’s Examine Buying The New Must-Have Tech Thing

New Tech Thing = $300

We definitely get high off of buying stuff.

Here are the dopamine hit points I identified.

- Pre-Purchase: Browsing, looking at photos, reading reviews, etc.

- Buying it: Hitting that purchase button and getting the confirmation email.

- Tracking it: I think this is the part we get the most dopamine from. Seeing the item make its way to you as you refresh tracking information.

- Getting and unboxing it: Lifting that brand new thing out of its packaging is a rush!

- Using it: Setting it up and basking in the new thing energy.

What about after that?

- One month later you get the credit card bill. That’s not fun to pay.

- A year later the shine is gone and it’s just one more thing in the piles of the stuff in your house.

- Two years later it may be sitting unused in a closet or drawer.

- 3 years later it’s obsolete and you have to pay $300 again to replace it.

Let’s Examine Investing $300

Investing $300

How can we get high off of saving?

Potential dopamine hits

- Making the deposit. Your Net Worth goes up and you feel like a boss.

- Investing it. Choosing what you’re going to buy — shares of a stock, ETF, Mutual Fund etc. — and making the transaction.

After That

- A month later you don’t have an extra $300 on your credit card bill.

- 5 years later your $300 may be $405 (given a 6% rate of return).

- 35 years later your $300 may be $2,438 (given a 6% rate of return).

The high you get from saving is long lasting and regret-free. When you’re older you’ll wish you saved more vs. bought more stuff (most of which will be in a landfill by then).

The Satisfaction of “Enough”

I’m not saying never buy anything, I got some shirts from Wildfang for what I named “Cute Shirt Summer” this year, but mindfully think about every purchase before hitting the buy button. Try to get to a place where you look around your house and think, “Everything I need I already have. I have enough.” Consumerism doesn’t want you to ever feel like you have enough. They don’t want you to get satisfaction from the things you already own. They want you to keep hitting the buy button to get dopamine hits with diminishing returns.

I have a spreadsheet where I list all of my assets and liabilities and it automatically calculates my Net Worth. Every time I make a deposit into a savings account or make a mortgage payment, I get to enter that number in and see my net worth go up. That gives me a much bigger high than buying something I don’t need off Amazon. I’m not denying myself pleasure, I’m building wealth and freedom.